Smart Solar Finance: How European Homeowners Are Making Solar Power Pay For Itself

Transform your solar energy ambitions into reality through innovative solar financing solutions that are revolutionizing clean energy adoption across Europe. Power Purchase Agreements (PPAs) now enable zero-upfront installations while guaranteeing fixed electricity rates for up to 25 years. Solar leasing programs combine equipment financing with comprehensive maintenance packages, reducing traditional ownership barriers and operational risks. Crowdfunding platforms connect environmentally conscious investors with solar projects, creating community-driven funding opportunities that benefit both installers and property owners.

Modern financing mechanisms have transformed solar from a luxury investment into an accessible energy solution for businesses and homeowners alike. Performance-based financing models, green bonds, and specialized solar loans now offer tailored solutions that align with diverse financial capabilities and energy needs. These innovative approaches not only minimize initial capital requirements but also maximize long-term returns through reduced energy costs and enhanced property values.

By leveraging these advanced financing options, European property owners can immediately begin their solar transition while maintaining healthy cash flows and achieving substantial energy savings. The combination of declining technology costs and sophisticated financing structures has created an unprecedented opportunity to embrace sustainable energy solutions without compromising financial stability.

Power Purchase Agreements: The Zero-Investment Solar Solution

How PPAs Work for Residential Properties

Power Purchase Agreements (PPAs) offer European homeowners a straightforward path to solar energy adoption without substantial upfront investments. Under a residential PPA, a solar provider installs, owns, and maintains the solar system on your property while you agree to purchase the generated electricity at a predetermined rate, typically lower than conventional utility prices.

The process begins with a comprehensive property assessment to determine optimal system sizing and expected energy production. Once installed, you’ll only pay for the actual electricity generated by your solar panels, usually through monthly payments. These rates are often fixed or have predictable escalators, providing long-term price stability and protection against rising utility costs.

Most residential PPAs in Europe span 20-25 years, during which the provider handles all maintenance and performance monitoring. This arrangement ensures optimal system operation while eliminating maintenance concerns for homeowners. Many PPAs also include performance guarantees, ensuring your system generates the promised amount of electricity.

At the contract’s end, homeowners typically have several options: extending the agreement, purchasing the system at fair market value, or having it removed. This flexibility, combined with immediate energy savings and zero upfront costs, makes PPAs an increasingly popular choice for European households embracing solar energy.

Commercial PPA Benefits

Commercial Power Purchase Agreements (PPAs) offer businesses and industrial facilities a sophisticated approach to solar energy adoption without capital expenditure. Under this arrangement, companies benefit from immediate energy cost reduction while maintaining predictable electricity prices for 15-25 years, effectively hedging against market volatility.

For industrial consumers, PPAs provide substantial operational advantages beyond financial benefits. The solar developer assumes responsibility for system performance, maintenance, and monitoring, allowing businesses to focus on their core operations. This arrangement typically results in 20-30% savings on electricity costs from day one, with potential for greater savings as grid electricity prices rise.

European businesses particularly benefit from PPAs due to the continent’s strong regulatory framework supporting renewable energy initiatives. The model allows companies to meet sustainability targets and compliance requirements while enhancing their environmental, social, and governance (ESG) credentials. This proves increasingly valuable for businesses seeking to attract environmentally conscious customers and investors.

Additionally, PPAs often include performance guarantees, ensuring optimal system output throughout the agreement term. Companies can leverage these agreements to demonstrate long-term commitment to sustainability while maintaining budget certainty and improving their competitive position in an increasingly carbon-conscious market.

Solar Leasing: The New European Standard

Flexible Payment Structures

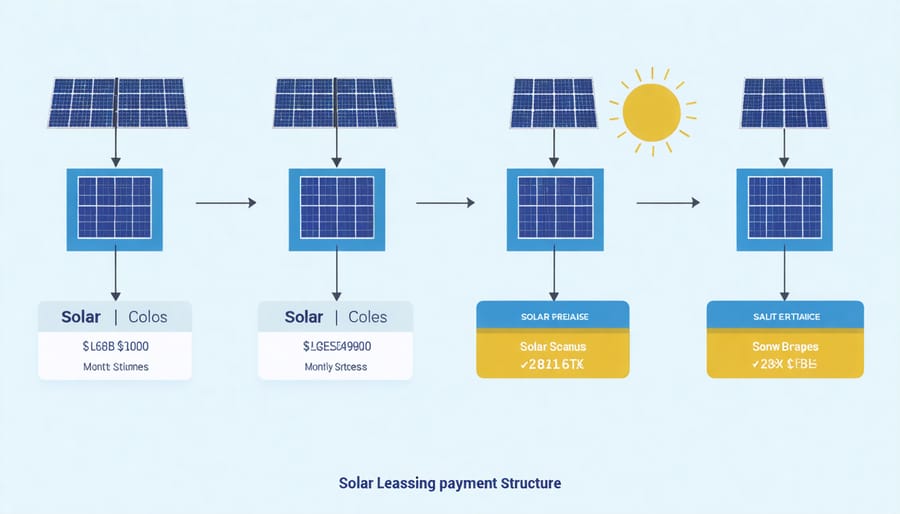

Modern solar leasing options have evolved to accommodate diverse financial situations and energy requirements. Pay-as-you-save models allow customers to make payments based on their actual energy production, ensuring costs align with benefits. This approach particularly benefits seasonal businesses with fluctuating energy needs.

Fixed monthly payments offer predictability for budget-conscious consumers, while escalator payments start lower and increase gradually, ideal for growing businesses expecting revenue growth. Some providers also offer custom payment structures that consider specific energy consumption patterns and financial capabilities.

Performance-based payments have gained popularity, where monthly costs are directly tied to system output. This model provides additional security, as payments decrease if system performance falls below guaranteed levels. Balloon payment options are available for those preferring lower monthly payments with a larger final payment, while early purchase options allow customers to transition to ownership when financially advantageous.

These flexible structures eliminate traditional financing barriers, making solar energy accessible to a broader range of European consumers and businesses.

Green Loans and Sustainable Mortgages

Interest Rates and Terms

Our financing solutions offer competitive interest rates ranging from 2.9% to 6.5% APR, tailored to your specific project needs and creditworthiness. Traditional bank loans typically feature 5-15 year terms, while innovative green financing options can extend up to 20 years, significantly reducing monthly payments.

Power Purchase Agreements (PPAs) provide an alternative structure without conventional interest rates, instead offering fixed energy rates typically 10-30% below market prices. These agreements usually span 15-25 years, ensuring long-term price stability.

Solar leasing arrangements generally include annual escalator rates of 1-2.9%, with terms ranging from 10-20 years. For business customers, our ESCO financing model offers performance-based terms, where repayment is directly linked to achieved energy savings.

European Union-backed green loans often feature preferential rates starting from 1.9% APR, supported by various national incentive programs. These solutions typically offer grace periods of 6-12 months and flexible repayment schedules aligned with your energy production cycles.

For commercial installations, we provide project-specific structured finance options with terms up to 25 years and the possibility of interest-only periods during the initial implementation phase.

Government Incentives and Tax Benefits

Across Europe, governments are actively supporting the transition to renewable energy through various government incentives for solar adoption. These financial support mechanisms make solar installations more accessible and economically attractive for both homeowners and businesses.

The European Union’s Recovery and Resilience Facility has allocated substantial funding for green energy initiatives, with member states offering diverse incentive programs. Feed-in tariffs remain popular in countries like Germany and France, allowing solar system owners to sell excess electricity back to the grid at guaranteed rates. Investment grants covering up to 40% of installation costs are available in several regions, particularly for residential installations.

Tax benefits form another crucial component of solar financing support. Many European countries offer VAT reductions on solar equipment and installation services. Accelerated depreciation schemes help businesses optimize their tax positions when investing in solar infrastructure. Property tax exemptions for buildings with solar installations are becoming increasingly common, especially in Nordic countries.

Innovation-focused grants target specific applications, such as building-integrated photovoltaics (BIPV) and agrivoltaics. The European Investment Bank provides preferential lending terms for large-scale solar projects, while national development banks offer specialized green credit lines with reduced interest rates.

To maximize these benefits, it’s essential to stay informed about regional variations and application deadlines. Many incentives are time-sensitive or have annual caps, making early planning crucial for successful implementation. Local energy agencies often provide free consultation services to help navigate available options and optimize financing strategies.

The diverse range of financing solutions available in today’s growing European solar market offers something for everyone, from homeowners to large industrial facilities. When selecting the right financing option, consider your long-term financial goals, current cash flow situation, and desired ownership structure. Power Purchase Agreements offer flexibility and minimal upfront costs, while solar leasing provides a straightforward path to clean energy adoption. Traditional loans and green mortgages remain solid choices for those preferring direct ownership. The key is to partner with experienced financial advisors who understand local incentives and can tailor solutions to your specific needs. By carefully evaluating these options and matching them to your circumstances, you can make solar energy a reality while maintaining financial stability and maximizing returns on your investment.

Leave a Reply